Intel has staged an unexpected comeback, posting a solid profit in its latest quarterly report. The company reported net income of $4.1 billion, or 90 cents per share, for the quarter ending in September—a striking reversal from last year’s massive $17 billion loss, or $3.88 per share. Revenue climbed 3% to $13.7 billion, a sign that Intel’s sweeping restructuring strategy is beginning to deliver results.

Investors took notice. Shares jumped nearly 8% in after-hours trading, closing at $41.10. The surge comes after a string of strategic moves and renewed confidence, boosted in part by U.S. government investment earlier this year.

Government Support and Strategic Shifts

President Donald Trump said in August that the U.S. government owned 10% of Intel. This step was part of a national effort to strengthen companies critical to national security. While unexpected from a Republican administration, the decision aimed to stabilize Intel’s future and reinforce the U.S. semiconductor industry.

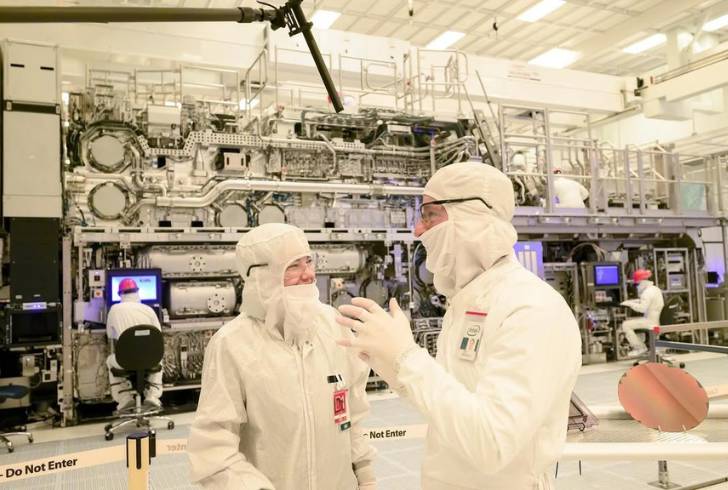

Intel exchanged its shares for nearly $9 billion in funds it previously received under the CHIPS and Science Act of 2022. In return, the company committed to expanding its manufacturing capabilities within the United States. This move aligns with growing efforts to reduce reliance on foreign chip production and restore U.S. technological leadership.

Newly appointed CEO Lip-Bu Tan has also taken decisive action. Thousands of jobs have been cut, and several projects have been shelved to focus on core priorities. His strategy centers on rebuilding efficiency and catching up with rivals that have outpaced Intel in innovation and performance.

Intel’s Ongoing Challenges

Founded in 1968, Intel shaped the early days of personal computing. Yet, the company stumbled when mobile technology transformed the market after Apple’s release of the iPhone in 2007. That shift left Intel trailing behind competitors who adapted faster to the smartphone and AI revolution.

The rise of artificial intelligence has deepened this challenge. Nvidia now dominates the AI chip sector, a market where Intel once hoped to lead.

Intel’s comeback is starting to attract serious money. Nvidia just invested $5 billion, and SoftBank added another $2 billion, a clear vote of confidence from some of the tech world’s biggest names. For a company that spent years fighting to regain its footing, the message is simple: the industry is watching—and believing again.

Looking Ahead

Intel’s return to profit is a welcome start, but the real test lies ahead. Reclaiming its legacy in a market dominated by fast-moving rivals will take grit, patience, and flawless execution. Still, with renewed funding, strong leadership, and the backing of both investors and the U.S. government, Intel has momentum on its side.

Should its strategy succeed, the company could reclaim its status as a global leader in chip design and production—demonstrating that legacy firms can still reinvent themselves in a fast-changing tech economy.